Making payments has come a long way from the days of barter. We lived through the age of paper currency and now steadily moving towards a cashless economy. This economy thrives on digital payments through a Prepaid Payment Instrument.

PPI plays a significant role in creating a cashless economy. India, in particular, gained great attention for crossing 25 million real-time transactions through PPI. Hence, many see the impact of PPIs in banking and fintech as undeniable.

These instruments are mostly pre-loaded cars. Examples of PPIs in India include platforms like Paytm, GPay, gift cards, credit and debit cards. Today’s article takes a look at the types of PPI found in the industry. It also helps you in choosing the right prepaid payment instrument for your business needs.

Why be part of the PPI hype train?

PPIs are more than just a way to make payments. They are a revolutionary concept that benefits consumers and businesses. There is immense potential for companies to drive sales, increase revenue, and enhance the customer experience through PPI.

PPIs officially launched in 2002 and the market grew quickly in the following years. The digital India strategy and demonetization only accelerated its growth. These measures resulted in greater mobile wallet usage, more digital payments, and widespread adoption of UPI transactions. Additionally, the Pandemic accelerated PPI usage. Many people prefer cashless and contactless payments over traditional payment methods.

A prepaid payment instrument helps consumers pay for products and services in just a few steps. Now, they don’t have to carry physical cash or sign receipts at PoS terminals. PPIs created a landscape where making payments was quick and convenient. They also came with zero liability features and notable fraud monitoring measures to protect the users.

The reasons stated above and more were why PPI transactions in India rose quickly. Statista reports that in 2020 alone, there were more than five billion PPI payments made in India. Years later, PPIs are now becoming the preferred payment method in the subcontinent. Hence, businesses are better off joining the bandwagon or risk getting left in the dust.

Benefits of using a prepaid payment instrument for business

PPIs can increase sales, profitability, and customer loyalty. Businesses can earn commissions on every transaction made through mobile wallet-enabled prepaid cards. Today, businesses must leverage PPIs to access the massive number of smartphone users back in India.

A business that successfully implements PPI can enable numerous features for its users. The PPI reforms issued by the RBI made it clear that everyone must ride the prepaid payment instrument wave and enjoy the rewards. Listed below are the measures announced by the RBI in 2021. These measures came into force on 31st March 2022.

· PPIS can offer real-time gross settlement and national electronic funds transfer facilities to their users.

· Interoperability of full KYC (Know Your Customer) PPIs is mandatory.

· The maximum balance of mobile wallets went from 1 lakh to 2 lakhs.

· Cash withdrawals enabled for full-KYC PPIs of non-bank PPI issuers.

The reforms listed above can level the playing field between banks and non-banks. It can also increase the number of full KYC PPIs and drive greater financial inclusion. Businesses that take payments or remittances through PPI experience many benefits. These benefits include greater customer acquisition, loyalty and retention, long-term profitability, and greater customer lifetime value.

Choosing the right prepaid payment instrument for your business

Let’s take a look at the fundamentals of PPI before we delve deeper into the subject.

Prepaid Payment Instruments

PPIs are made-up virtual cards and digital wallets that make it easy to purchase products and more. People can buy services, send money, and transfer funds electronically through a prepaid account. Users can transfer money from their accounts or through other payment instruments. At first, the maximum loading limit is only RS. 50,000 per month. However, after the 2021 RBI monetary policy, the balance limit went up significantly. Now, the maximum loading limit allowed is 2 Lakhs INR.

Types of Prepaid Payment Instruments

Broadly, PPIs are classified into three categories. Listed below are those categories

1. Closed system PPIs

2. Semi-closed system PPIs

3. Open system PPIs

Closed system PPIs

Gift cards, smart cards, and loyalty program cards fall into this category. These payment instruments work exclusively within the business that issued the card. Here, customers cannot withdraw cash or purchase goods and products from third parties. Also, closed-system PPIs do not need RBI approval or authorization to implement and issue these PPIs.

Semi-closed system PPIs

YONO, Mobikwik, Phone Pe, PayTM, Gpay, etc. are among the most famous brands that come under this category. Here, companies or banks can issue these semi-closed prepaid payment instruments. However, they must first get approval and authorization from the RBI before proceeding. PPIs used for mass transit systems and prepaid meal instruments also come under this category. However, these PPIs do not provide features like cash withdrawal or fund transfer.

The semi-closed system PPIs can be further classified into three categories. They are

· Minimum detail PPI

· Full KYC PPI

· Loading-only from bank PPI

Minimum detail PPI: The only requirements here for the PPI holder are their name and phone number. Additional details like address, PAN card, bank account details, etc. are not required by the issuer. The maximum amount of money a user can load into this category is RS. 10,000 per month

Loading-only from bank PPI: The only way users can load money in this PPI is through their bank account and no other means. Similar to the previous type, the maximum amount a user can load into a PPI is RS. 10,000.

Full KYC PPI: Here, the PPI holder’s relevant details are gathered and shared. Full KYC here includes gathering information like the name, phone number, address, Aadhar details, PAN details, bank account information, and photographs. The maximum limit of money a PPI holder can load here was one lakh but now increased to two lakhs.

Full KYC payment instruments help customers remit money, and purchase products and services from merchants or businesses. Semi-closed PPIs do not have cash withdrawals but they do allow cash withdrawals and fund transfers for full KYC holders.

Open system

Any cards issued by banks that are approved by the RBI come under the open system category. These payment instruments enable the purchase of products services, remittances, and fund transfers. Users can also use these cards for cash withdrawals or at PoS terminals.

How to implement PPI for your business?

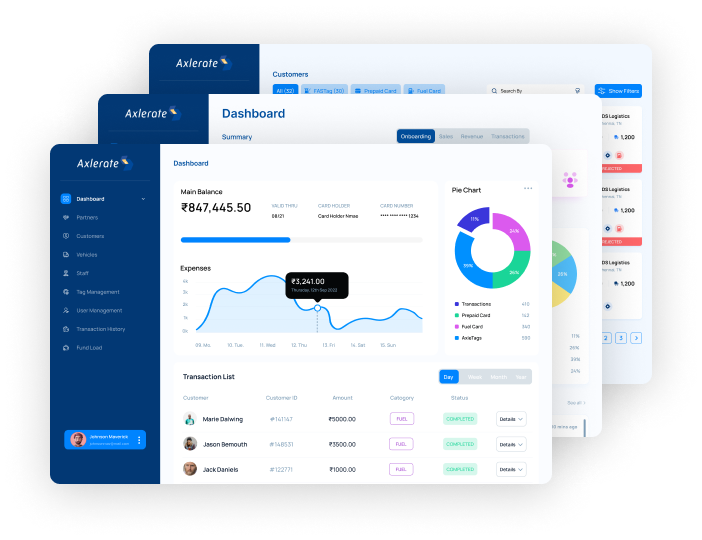

The best approach to implementing a PPI for your business partnering with a fintech services provider. These companies help businesses go to market with a ready-made prepaid card and mobile wallet. Companies like Axlerate help you go live immediately instead of waiting for months with no resolution.

Fintech services providers like Axlerate can leverage their connections with banks to help businesses issue customized PPIs. These companies enable secure transactions and an easy way to load funds. You can load or unload funds here using IMPS, NEFT, RTGS, and UPI, similar to how it’s done in regular banks.

Conclusion

There is no denying the impact PPI has on India. The widespread adoption and usage in the past few years indicate this is no passing trend. It is here to stay as more Indians are adopting this payment method. Businesses seeing this trend must leverage it to their benefit. Either by developing a PPI system in-house or partnering with a notable fintech service provider.

Many companies provide fintech services in India. Companies like Axlerate have PPI cards and other fintech services that help you achiene your goals. Their advanced systems and intuitive dashboards help you manage your PPI cards from a single platform. These companies help you tap into the potential that PPI has and help you reap the many rewards.