Understanding the infrastructure of neobanks vs traditional banks

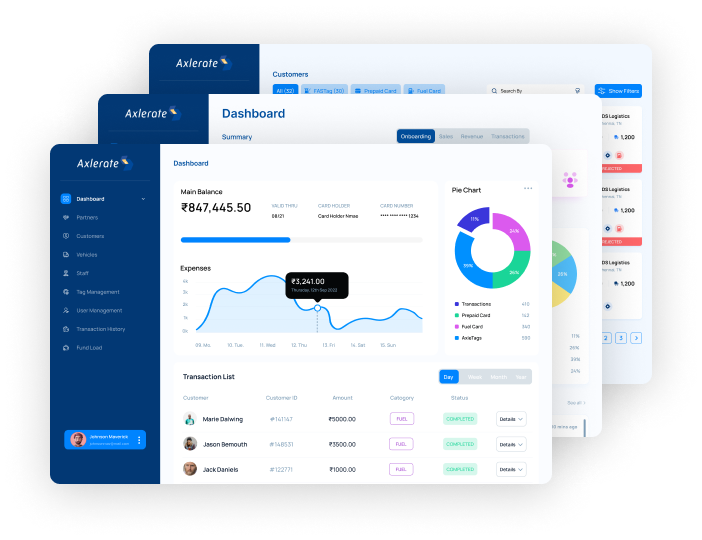

Traditional banks provide customers with the convenience of in-person transactions and services, whereas neobanking platforms operate entirely in the digital space, often known as “digital banks” or “challenger banks”. No physical branches exist for these online banking platforms. One of the key differences in neobanks vs traditional banks is that, unlike traditional banks that store data across various systems that limit accessibility, neobanking technology employs cloud-based systems to provide a streamlined solution that allows both banks and customers to share and analyze information with ease.

What are the different types of traditional and neobanking services?

Traditional banking institutions offer a wealth of services, like mortgages and loans, credit cards, investments, insurance policies and financial guidance. These services can be accessed through the bank offices, branches and ATMs. On the other hand, Neobanking services are available through both mobile apps and web-based platforms, providing customers with the convenience of accessing their finances on-the-go. Neobanking platforms offer a range of services, from conventional deposit accounts and loans to budgeting tools, cashback rewards programs, investment options, and cryptocurrency trading options.

Pros and Cons of neobanks vs traditional banks

There are a number of advantages and disadvantages with neobanks vs traditional banks based on certain factors including services, security, cost, customer service, personalization and processing time.

- Services: Compared to traditional banks, neobanking services are limited and focus on fundamental banking needs such as savings accounts, credit or debit cards, and personal loans and few other services as they do not have the same level of resources or customers as traditional banks.

- Security: Strict regulatory guidelines are followed by traditional banks to secure customer deposits and data with a robust infrastructure while neobanks may encounter the possibility of cyber-attacks and data breaches. However, neobanking technology has evolved to handle security issues with necessary protocols and advancements in cybersecurity.

- Cost: Traditional banks incur higher costs in maintaining physical branches, leading to higher fees for customers. In contrast, neobanks have lower operating costs and can offer lower or no fees and competitive interest rates.

- Customer Service: Neobanking platforms prioritize customer service by utilizing responsive solutions, while traditional banking often relies on outdated systems and regulations that result in a lack of innovation and customer focus.

- Personalization: Traditional banking usually adopts a one-size fits all approach while neobanking focuses on personalization using data analytics and technology to provide customers with customized tools, services and notifications for making informed financial decisions.

- Processing time: In comparison to traditional banking, neobanking technology has revolutionized the way payments are made with its fast real-time payment systems that enable near instantaneous transactions. International funds transfers can now be completed within minutes instead of days or weeks.

Traditional banking vs neobanking: Which is better for you?

When assessing your financial requirements, it is crucial to think about whether traditional banking or neobanking is the better option to handle your finances. Although traditional banking has a long history, neobanking is rapidly gaining popularity as it provides contemporary and efficient solutions suitable for the current digital landscape.

If you require complex financial services and assistance from a banking representative, then traditional banking could be the perfect solution for your needs. However, if convenience is your priority, and you desire access to advanced financial tools with a digital ecosystem in a single platform, neobanking services will likely be more advantageous for you.

Let’s Wrap Up!

Traditional banks offer the advantage of in-person services, while neobanking platforms provide customers with a completely digital experience. Banks offer services including mortgages, loans, credit cards, investments, and insurance, while neobanking platforms provide similar options including budgeting tools, rewards programs, investment opportunities, and even cryptocurrency trading. Choosing between neobanks and traditional banks can be a difficult decision, as both offer their own distinct benefits and drawbacks. When making your choice, look into the services, security, cost, customer service, personalization and processing time.

Axlerate is a unified platform for Logistics management, payments and services. Our solutions help to simplify tolls, fuel purchases, fleet expenses, loans, insurance, escrow, payments, truck booking, fleet management and the buying and selling of logistics products and services.