Get the inside scoop on why commercial truck insurance is a road-trip superhero

Commercial vehicle Insurance is essential for protecting your business assets by reducing the financial burden in accidents or theft. It’s often a legal requirement in many places for operating commercial vehicles on public roads. There are a number of things involved in understanding commercial fleet insurance. It ensures financial security, preventing significant losses from unexpected accidents. Moreover, proper coverage builds customer trust, showing your commitment to their safety and increasing engagement with your business.

Uncover the fascinating world of commercial fleet insurance options

There are a number of trucking insurance companies that provide different commercial truck insurance coverage options including liability insurance (for injury and property damage to others), physical damage coverage (for collisions, theft, and vandalism), uninsured/underinsured motorist coverage (for accidents with insufficiently insured drivers), cargo insurance (for goods in transit), and bobtail insurance (for liability when driving without cargo or a trailer).

Discover the forbidden activities that even insurance can’t handle

Businesses rely on commercial fleet insurance to comprehensively cover their vehicles, safeguarding them from potential financial liabilities arising from unexpected events. However, it’s crucial to remember that certain activities usually fall outside the scope of coverage. These include intentional acts, wear and tear, employees using vehicles for personal reasons, and transportation of hazardous materials.

Join the ride to dispel the wild rumors floating around commercial truck insurance

- Myth 1: Personal Auto Insurance is Sufficient for Commercial Vehicles. Personal auto insurance doesn’t cover commercial vehicles. Businesses require separate commercial vehicle insurance for proper protection during work-related accidents.

- Myth 2: Commercial Vehicle Insurance is Too Expensive. Prices may vary based on certain factors, however, making a well-informed decision and investing in the best commercial fleet insurance coverage will protect your business from significant financial setbacks in the long run.

- Myth 3: All Commercial Vehicles Require the Same Coverage. One size does not fit all! Different types of vehicles demand specialized commercial truck coverage, tailored to their unique usage and specific industry requirements.

- Myth 4: Comprehensive Coverage is Unnecessary. Comprehensive coverage is a smart investment because it safeguards your business from non-collision incidents, such as theft, vandalism, or natural disasters.

- Myth 5: Commercial Vehicle Insurance is Only Necessary for Large Businesses. Commercial vehicle insurance is not limited to large companies, it offers benefits to any business using vehicles for work-related purposes, regardless of their size or fleet capacity.

It’s time to close the curtains on this conversation!

Commercial vehicle insurance is critical for protecting business assets. It offers diverse coverage options that reduce financial burdens from accidents or theft. However, there are common myths surrounding commercial vehicle insurance. Businesses must understand policy exclusions listed by trucking insurance companies and invest in the right coverage tailored to their specific needs for protection against financial setbacks.

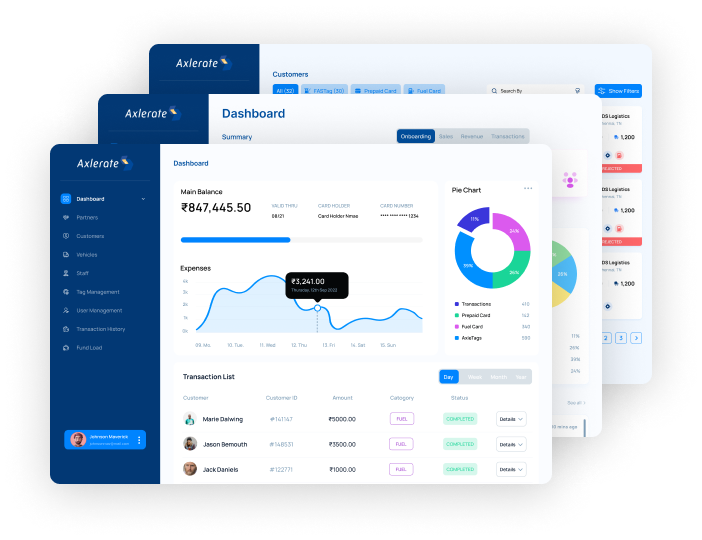

Axlerate is a unified fintech platform for logistics with products including AxleTags, AxleCards, AxleDrive, AxleFinance, AxlePay, AxleDirectory and AxleMarketplace. Our solutions help to simplify toll payments, fuel purchases and fleet expenses with FASTags, prepaid cards, fuel cards, capital loans, insurance, escrow, payments, online truck booking, GPS, fleet management software and the buying and selling of commercial vehicle spare parts.