What is fintech and how is it transforming the logistics industry?

Fintech is an evolving industry with innovative technological solutions to efficiently streamline financial processes. Fintech is now an emerging trend in logistics and supply chain management that initiates business transformation by providing assistance for administration, accounting, and automation in transportation and logistics. Fintech trends in logistics are gradually rising in terms of flexible payment terms, transparency in transactions and multiple financing options from banks and third-party vendors.

Why are fintech trends in logistics essential?

Logistics owners, fleet managers and truck drivers can solve the biggest challenges in logistics with fintech. Adopting fintech industry trends in logistics and supply chain management facilitates overcoming challenges in terms of financial systems, flexibility, and security. From managing on-road expenses to credit management and insurance claims, fintech is essential for logistics and supply chain management.

How is fintech adopted in logistics and supply chain management?

The emerging fintech trends in logistics and supply chain management that optimise operations include invoice management, credit management, insurance management, asset management and risk management.

- Invoice Management: The short-term and long-term payments and receivables or the working capital of a supply chain and shipping logistics firm needs to be streamlined and monitored on a regular basis. However, manually processing invoices involves a lot of time and effort and is often prone to error. Moreover, it is challenging to make payments.

- Credit Management: One of the biggest challenges of logistics firms is to meet the liquidity demands to ensure seamless operations. But most financial institutions or vendors refrain from providing financial aid owing to potential risks in financing or issuing credit. Fortunately, fintech in logistics specialises in acting as an intermediary between banks and lenders to provide and manage credit in terms of invoice and inventory financing through factoring or discounting modes. Fintech solutions also automate background checks and smart contracts through big data analysis in order to issue credit by reducing risks and avoiding loss of time.

- Insurance Management: Supply chain and shipping logistics firms are prone to high risk of equipment damage, accidents, cargo or asset theft and natural calamities. As a result, insurance is one of the predominant services that is increasingly utilised by logistics firms. However, banks or third-party insurance providers face challenges in drafting insurance policies in accordance with varied logistics operations. That is why fintech in logistics provides applications and services to streamline the insurance process from application to claims through smart contracts and also provide insights on personalised insurance schemes with big data analysis.

- Asset Management: The management of assets is a difficult task when there is lack of transparency or security. It becomes almost impossible to monitor or keep track of assets and to secure the assets or its data. Fintech trends for the future of asset management is the ideal solution. Fintech in logistics employs artificial intelligence and machine learning to enhance the collection and analysis of big data that facilitates efficient monitoring of assets or shipments and processes in real-time. It reduces insurance claims by reducing the potential threats or damages in terms of theft or accidents.

- Risk Management: Fintech in logistics provides insights to banks or third-party lenders on creating firm-specific insurance policies by predictive analysis of risk using big data analysis. Moreover, fintech leverages the potential of artificial intelligence, machine learning and blockchain technology to provide, record and analyse asset data in real-time and store it in a secure database that cannot be tampered. This sort of visibility and security with automated fraud detection prevents asset theft or fraudulent activities in data exchange.

Let’s Wrap Up!

Fintech industry trends in logistics and supply chain management is revolutionising the logistics industry through connected, quick and automated payments. The integration of fintech trends in transportation and logistics provides a seamless experience in terms of invoice management, credit management, insurance management, asset management and risk management by leveraging the potential of artificial intelligence, machine learning and blockchain technologies.

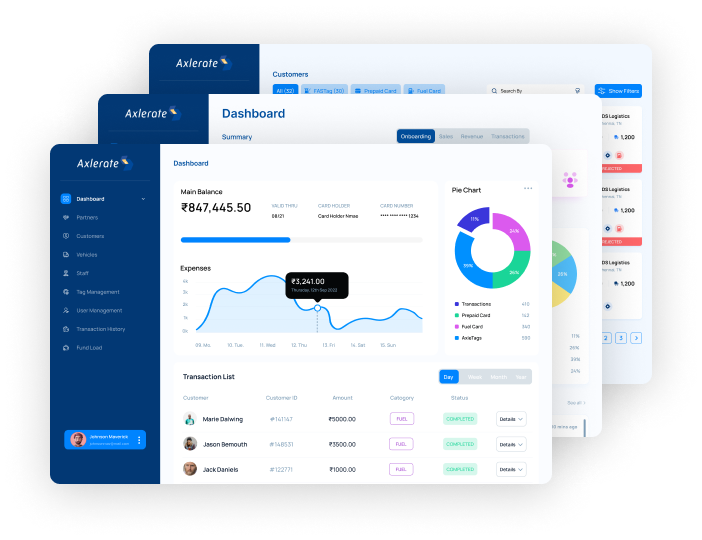

Axlerate is a unified platform for Logistics management, payments and services. Our solutions help to simplify tolls, fuel purchases, fleet expenses, loans, insurance, escrow, payments, truck booking, fleet management and the buying and selling of logistics products and services.