What is credit management and how does it work?

Credit management is the process of efficiently issuing credit and collecting the payments when it is due. Lack of proper control over credit management in logistics results in additional expenses in terms of interest rates and might even lead to debt. For instance, the supplier may allow a credit period of 10 days for payment to be made after the purchase of goods and the company might either depend on its existing resources or on customers to make their payments in order to pay the supplier within the stipulated time. Therefore, capital loans for logistics especially to cover trip expenses is crucial for smooth operations.

Why is capital loans for logistics crucial for smooth operations?

Credit management in logistics needs utmost attention because it affects the smooth operations within the firm and also the movement or transfer of goods outside the firm. Any delay in the payment by the customers or the company to the supplier affects the credit worthiness or credibility of the company and in turn affects its growth. The integration of fintech for efficient credit management in logistics helps in securing a commercial line of credit for logistics.

How is fintech changing the game in capital loans for logistics?

- Optimise Cash Flow: One of the biggest challenges in the logistics industry is managing the working capital. The receivables and payables of the firm should be tracked efficiently to optimise the cash flow for seamless operations. Fintech solutions provide commercial working capital loans for logistics suppliers, firms and customers to make quicker payments with flexible terms and transaction methods in order to ensure sufficient working capital and seamless cash flow in various operations within and outside the firm.

- Assess Credit Worthiness: Most banks or third-party lenders hesitate to provide credit management services for logistics owing to the complexity in assessing credit worthiness of such firms. Lack of credit management services results in the inability to meet the liquidity demands of the logistics firm. In order to issue a credit by reducing risks and avoiding loss of time, fintech solutions employ big data analysis and automate background checks and smart contracts to assess the credit worthiness of the parties involved in the transaction.

- Increase Credibility and Growth: A higher credit rating or score increases the credibility of a firm and allows suppliers to extend credit terms in the future whenever required. It also promotes growth as banks or third-party lenders provide a commercial line of credit for logistics based on the previous credit history. Fintech solutions provide efficient tools and processes to ensure efficient credit management which in turn increases credibility and facilitates growth.

Let’s Wrap Up!

Credit Management in logistics plays a crucial role in business finance. It promotes financial stability and scope for growth resulting from seamless cash flow for business operations. While issuance and payment of credit involves risk, the integration of fintech solutions in credit management services provides innovative processes and big data analytics to reduce risk and manage credit efficiently. Fintech companies provide the best business line of credit for logistics by optimising cash flow, assessing credit worthiness and increasing credibility and growth.

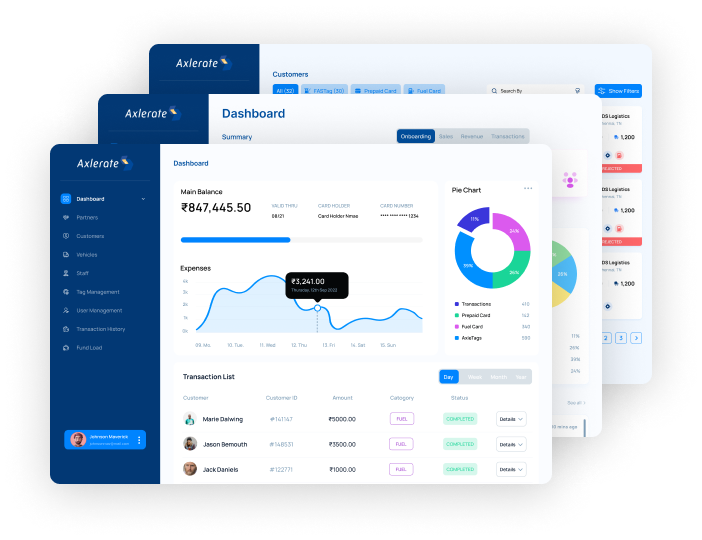

Axlerate is a fintech platform for logistics that helps you simplify invoice payment management systems for logistics payments to provide uninterrupted cashflows through QR codes, payment pages, links, invoices and web integrations.