Understanding the basics of Neobanking

Neobanks are technologically advanced FinTech companies that offer convenient online banking services without traditional physical branches. Neobanking is revolutionizing the financial landscape, allowing customers to access a range of digital services from one secure platform. Over 8,000 banking customers surveyed by Capgemini revealed that 75% of them would be more inclined to FinTech competitors that offer neobanking services due to their fast and affordable services as well as accessibility and simplicity. While global neobanks cater to all individuals, neobank for business is gaining popularity owing to its features and convenience.

What services does a Neobank offer?

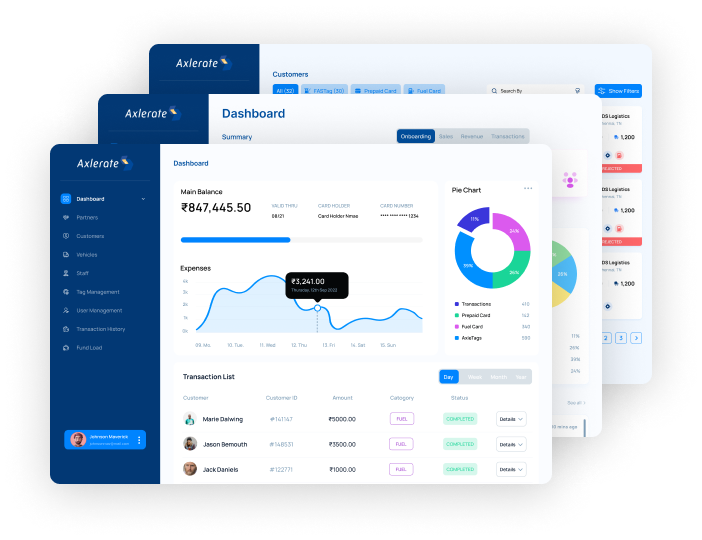

Fintech neobanks offer customers a comprehensive range of financial services, making it simple for them to handle their funds efficiently. Customers can utilize neobanking to manage a wide range of financial activities, including transferring money, paying bills, investing, exploring loan options, and setting up savings accounts. Moreover, customers can also access budgeting tools, analytics dashboards, and some global neobanks even provide insurance or cryptocurrency services. Using neobank for business will be highly efficient to streamline financial management.

How can Neobanking services benefit customers?

- Cost-savings: The absence of physical branches in offering neobanking services creates an opportunity for long-term cost savings. Apart from the low or zero charges on multiple transactions, customers can also benefit from attractive interest rates offered by Fintech Neobanks.

- Accessibility: Neobanks provide unparalleled levels of convenience and superior flexibility, enabling customers to manage their finances around the clock and handle transactions on-the-go without having to adhere to banking hours. Moreover, neobanks use AI customer service technology to rapidly resolve any queries or issues with timely precision for a satisfactory experience every time.

- Security: Fintech Neobanks are revolutionizing online safety through the use of biometrics and two-factor authentication. Moreover, by utilizing Artificial Intelligence and Machine Learning technologies to identify fraudulent accounts or suspicious activities swiftly, neobanks provide users with a secure yet convenient experience.

Why should you consider Neobanking services for Logistics?

The logistics industry is a complex payment ecosystem that involves multiple players. From fleet managers and truck drivers to suppliers, customers and owners of the business, they all involve in various financial transactions, spanning from everyday administrative duties to operational and delivery-related payments. Streamlining the payment process in logistics can be a hassle, but utilizing neobank for business will be the ideal solution.

Neobanking services for logistics can offer innovative financial solutions that deliver greater speed, security and visibility. By eliminating the need for multiple platforms, logistics companies can simplify their payout process and easily make payments to vendors, employees, customers, and partners from a single location.

Let’s Wrap Up!

Fintech Neobanks leverage technology to offer a range of convenient online banking services without the need for a physical branch. This includes transferring funds, investing and loan options, as well as creating savings accounts with access to an analytics dashboard and other features. Neobanking services benefit customers by providing cost-savings, accessibility and security. Utilizing neobank for business transactions and financial management especially for logistics, helps to streamline payouts from a single platform.

Axlerate is a unified platform for Logistics management, payments and services. Our solutions help to simplify tolls, fuel purchases, fleet expenses, loans, insurance, escrow, payments, truck booking, fleet management and the buying and selling of logistics products and services.