Why is cargo insurance for trucks necessary in logistics?

The logistics industry involves shipment delivery that has to meet certain requirements like safe handling of goods and timely delivery. While goods are in transit there is a chance of goods being damaged, stolen or lost due to various factors. Therefore, the need for commercial truck cargo insurance is crucial to prevent major financial loss in terms of cargo damage or theft.

The financial loss in terms of cargo damage and theft is huge. For instance, fleet vehicle collision cost sums up to $70,000 per year on average (Source: G2TechMarketplace). Moreover, CargoNet, a cargo theft reporting firm revealed that $223 million worth cargo was stolen in 2022. Cargo insurance for trucks can help to efficiently mitigate such risks.

4 common causes of commercial vehicle accidents

There are a number of causes for commercial vehicle accidents including improper cargo loading, poor vehicle maintenance, unrealistic delivery timelines and unpredictable circumstances. In comparison to the loss that these issues can demand, the trucking cargo insurance cost is the bare minimum and helps to handle such costly expenses.

- Improper cargo loading: Collisions from a lack of control often occur when trucks are overloaded or don’t have enough loads, which causes a weight imbalance especially while making turns on narrow roads.

- Poor vehicle maintenance: Vehicle-related issues caused 6 percent of truck accidents (Source: FVF Law). Irregular maintenance can result in brake issues, tyre blowouts and failure of suspension and lights.

- Unrealistic delivery timelines: A survey conducted by Save Life Foundation in 2020 revealed that almost 50% of the respondents drive vehicles even if they are feeling fatigued or sleepy in order to meet unrealistic delivery timelines.

- Unpredictable circumstances: A sudden change in climatic conditions can cause accidents. For instance, fog can affect visibility and wet roads can cause vehicles to lose balance.

What type of coverage does Truck load insurance provide?

There are different kinds of cargo that need to be delivered, some might be perishable or fragile items or even chemical components at a higher risk of explosion. In all these cases, protecting such goods in transit is necessary. However, you can mitigate the risk of unexpected financial losses for your goods and merchandise with a truck load insurance. Most cargo insurance providers ensure different types of freight insurance coverage including collision and non-collision coverage.

- Collision coverage: Collision coverage ensures financial protection in any case of an accident involving your truck, whether it be due to a loss of control or from colliding with other vehicles.

- Non-Collision coverage: Non-collision coverage offers protection from unexpected damages or losses that can often arise due to theft, fire, vandalism and other unforeseen circumstances like vehicle downtime and refrigeration breakdown resulting in the damage of sensitive goods that require cold storage.

How to choose and claim commercial truck cargo insurance?

Cargo insurance providers have different metrics and requirements based on which a policy is framed. However, the best commercial truck cargo insurance will provide a simple process, maximum coverage, reliable claim settlements and expert support.

The process to raise a claim for insured cargo also differs with every provider, however the common way to file a claim includes reporting the accident or theft to the cargo insurance provider, recording the damages to understand the freight insurance coverage, sending a surveyor to inspect the losses, submitting the required documents and claiming insurance.

Let’s Wrap Up!

In the logistics industry there is always a possibility of goods being lost or damaged in transit as a result of improper cargo loading, poor vehicle maintenance, unrealistic delivery timelines and unpredictable circumstances. The most effective way to prevent financial strain for cargo damage is to claim commercial truck cargo insurance that provides collision and non-collision freight insurance coverage. The best cargo insurance providers will ensure a simple process, maximum coverage, reliable claim settlements and expert support. Truck load insurance can be claimed in case of a crisis by reporting the claim, recording the damages, inspecting the loss and submitting the required documents.

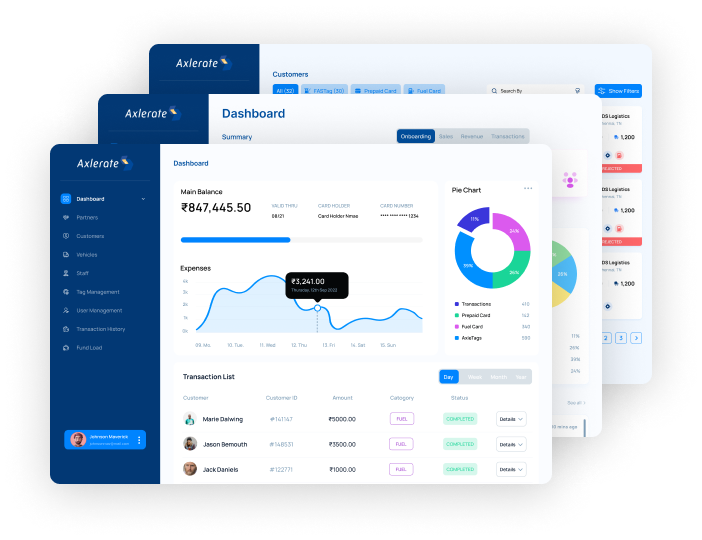

Axlerate provides a unified digital logistics management platform with transportation management solutions to simplify tolls, fuel purchases, fleet expenses, loans, insurance, escrow, payments, truck booking, fleet management and the buying and selling of logistics products and services.