Why do logistics companies need to care about risk management?

Workplace accidents within the premises lead to loss of life, money and machinery. But major activities of logistics companies operate outside the premises and are even more vulnerable to casualties, theft and disasters compared to other workplace settings. Therefore, trucking insurance coverage in logistics is of prime importance to avoid heavy losses owing to unprecedented circumstances.

According to research, 37.15% of logistics companies want to invest more in systems to automate risk identification and issue resolution (Statista, 2021). However, the predominant method of mitigating risks is to understand the importance of insurance for logistics and to adopt insurance policies to meet fleet expenses during a crisis.

What trucking insurance coverage do transport and logistics companies need?

The prime reason leading to a crisis in logistics operations is the lack of visibility. According to research, 69% of companies do not have total visibility over their supply chains (Source: FinancesOnline). However, though visibility can be increased by installing and adopting tech solutions, a major portion of risk can only be mitigated using freight insurance coverage. Logistics companies usually need freight insurance coverage in terms of cargo damage, cargo theft or hijacking, transportation delays and even loss of sensitive data.

What are the challenges of processing logistics insurance manually?

Manual processing of commercial truck insurance by trucking insurance companies has its own challenges in terms of time, enormous amounts of paperwork, errors and even lack of insights on risk prediction to craft a holistic or personalised freight insurance coverage for specific industries or operations. Logistics is a complicated industry in terms of risk owing to the fact that most operations occur outside the premises. Therefore, with manual processing, logistics owners may not be able to claim benefits on time or even get enough coverage for all the risks involved in the industry.

Why is utilizing fintech in trucking insurance coverage essential for logistics?

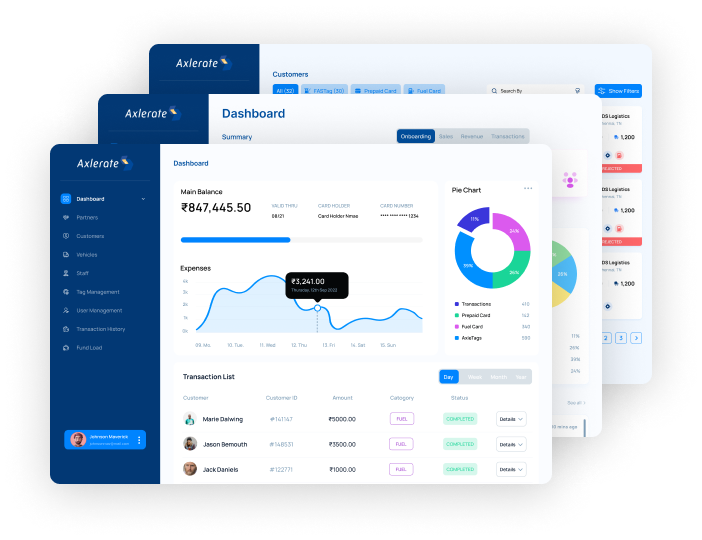

In simple terms, digitization or automation saves time, money. Fintech solutions provide insights to trucking insurance companies, banks or third-party lenders on creating firm-specific commercial truck insurance, freight cargo insurance or health insurance for truck drivers by predictive analysis of risk using big data.

Moreover, fintech leverages the potential of artificial intelligence, machine learning and blockchain technology to provide, record and analyse asset data in real-time and store it in a secure database that cannot be tampered. This sort of visibility and security with automated fraud detection prevents asset theft or fraudulent activities in data exchange which is of prime importance in claiming freight insurance coverage benefits.

Let’s Wrap Up!

Logistics industry is comparatively the most vulnerable to risks and therefore risk management in logistics is a matter of concern. The predominant means of mitigating risks is through trucking insurance coverage.

However, manual processing of commercial truck insurance, freight cargo insurance or health insurance for truck drivers lack maximum coverage for all fleet-related risks and is prone to errors, enormous amounts of paperwork and loss of time. Therefore, digitisation or automation of the process with fintech solutions help in crafting personalised, holistic and best insurance for logistics and speeds up the entire process!

Axlerate is a unified platform for Logistics management, payments and services. Our solutions help to simplify tolls, fuel purchases, fleet expenses, loans, insurance, escrow, payments, truck booking, fleet management and the buying and selling of logistics products and services.