What are the potential health hazards involved in truck driving?

Truck driver health is a matter of concern as a lot of time is spent on the roads and it leads to potential hazards that can cause severe or permanent health issues. Truck drivers are vulnerable to accidents as they usually drive long-haul vehicles that are difficult to handle on narrow or uneven roads. They also suffer from muscular pain, sleep disorders, lung issues, hypertension and are vulnerable to heart diseases, diabetes and strokes. Therefore, health insurance for truck drivers is crucial.

Truck drivers’ health mostly deteriorates due to improper sleep schedules, long hours of driving, exposure to loud engine sounds, and physical overexertion while loading and unloading cargo. Moreover, they can also be affected by unprecedented issues like inhaling poisonous gases due to the leakage from any chemical cargo that they transport. Thus, health hazards faced by truck drivers negatively affect their wellbeing.

How can health insurance help truck drivers during a crisis?

Health insurance for drivers is beneficial because it caters to their physical and financial well-being or stability by helping them pay for medical expenses and receive timely care during emergencies. However, it is important to ensure that medical insurance or health insurance for independent truck drivers or trucking companies has comprehensive coverage for most of the major or potential occupational hazards in trucking.

What are the loopholes in claiming health insurance for truck drivers?

Most trucking companies can afford to provide health insurance for drivers working for them. However, more often, these policies do not include coverage for serious and long-term illnesses or even for road accidents. On the other hand, many independent truck drivers do not seek health insurance because the premium is often high and they cannot afford it due to their meagre income. Moreover, claiming health insurance is a lengthy process that involves a lot of paperwork, time and effort.

Can fintech companies make health insurance claims easier?

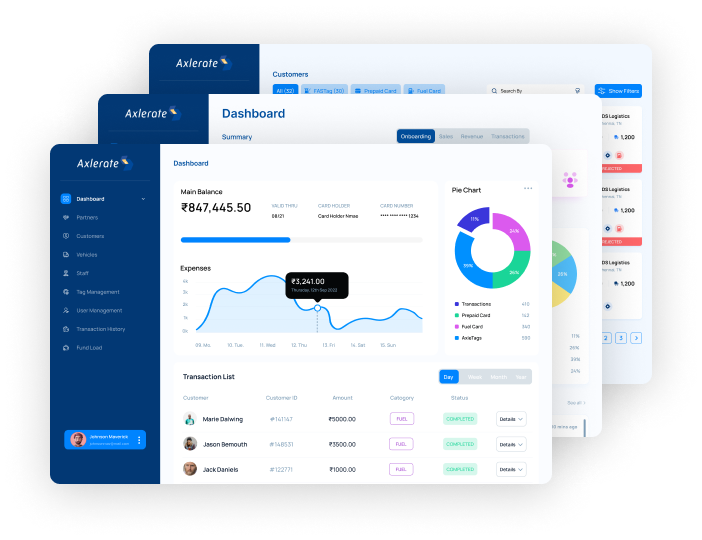

Fintech companies optimise the payment systems to ensure that truck drivers can claim insurance benefits during a crisis within the stipulated time. Fintech companies utilise digital data and KYC for quick disbursement of funds unlike traditional insurance processing which takes several days or even months to claim benefits with a lot of paperwork that is involved. Thus, fintech companies simplify insurance claims which is beneficial for both trucking companies and independent truck drivers. You can buy health insurance for truck drivers from reliable fintech companies.

Let’s Wrap Up!

Truck drivers spend most of their time on the roads and are exposed to multiple hazards that either cause casualties, injuries or affect their health with a serious or permanent illness. Though truck drivers are prone to accidents and health issues resulting from various reasons, only a few trucking companies or independent truckers opt for insurance policies.

Moreover, most insurance policies do not offer necessary coverage or even if they do, the claims take a relatively long time to be processed resulting in delayed fund disbursement. This is where fintech companies become a game changer as they optimise payment systems and processes to ensure quick fund disbursement with regard to the health insurance of truck drivers.

Axlerate is a unified platform for Logistics management, payments and services. Our solutions help to simplify tolls, fuel purchases, fleet expenses, loans, insurance, escrow, payments, truck booking, fleet management and the buying and selling of logistics products and services.