How does fintech in logistics and supply chain finance?

Logistics fintech is emerging as the ideal solution for financial supply chain management in terms of providing management optimization, financial assistance and process automation.

In terms of management optimization, supply chain finance fintech optimises the working capital and simplifies the payment process. With regard to financial assistance in logistics, fintech provides invoice and inventory financing, manages credit and initiates insurance services with ease and accuracy. Supply chain finance fintech also automates the process with fraud detection and smart contracts to save time and enhance security.

What is the role of fintech in optimising management in logistics?

Fintech in logistics simplifies and optimises financial supply chain management by automating payment methods, processing invoices electronically and creating channels to receive payments in a timely manner.

- Optimise transaction flow: One of the biggest challenges in logistics operations is the complexity and delays in transactions between two parties. Supply chain finance fintech providers counter these challenges efficiently by optimising the transaction flow through seamless integrations with multiple payment systems for better productivity and profit.

- Optimise working capital: Optimization of working capital enhances the cash flow, initiates growth through investments, and helps in the quick payment of debts. Supply chain finance fintech platforms simplify supplier finance management with the assistance of banks or third-parties to fund the working capital requirements.

Why is fintech necessary for financial assistance in logistics?

Financial supply chain management is a time consuming but essential process to meet the liquidity demands, risk oriented payments and necessary funds for growth. Fintech provides the following solutions to efficiently receive and manage financial needs.

- Invoice Financing: Fintech in logistics provides invoice financing to meet the liquidity needs. The parties need not wait until payment is received in order to manage expenses like employee wages, purchase of equipment or payment of debts because fintech facilitates short-term loans from banks or third-party lenders through factoring or discounting modes.

- Inventory Financing: Asset-based financing is widely used for financial supply chain management in terms of warehouse and vehicle demands that ensure seamless transportation of goods from suppliers to customers. Fintech enhances inventory management systems with hassle-free inventory financing through inventory loans or line of credit by generating data insights and enabling the reduction of financial risks.

- Credit Management: Issuing credit to logistic firms is a time-consuming and risk-oriented process if done manually with necessary data and background checks. Fintech in logistics provides big data collection, analysis and automation to facilitate smart contracts and background checks to issue credit to multiple firms and manage invoices in less time and with less or no risk.

- Insurance Services: Insurance is one of the most sought-after services in the logistics industry owing to the high risk of theft, accidents, and natural disasters that result in asset damage and loss. Fintech in logistics aims to optimise the process and reduce insurance claims through automation and big data. It facilitates smart contracts and analysis of potential risks to help banks or third-party insurance firms to offer customised insurance packages to logistic operations.

How does fintech help with process automation?

Manual processing of administrative and financial tasks in logistics is prone to error and loss of time. The integration of fintech in logistics will increase productivity by making processes more efficient through automation.

- Fraud Detection: Logistic Firms face challenges in terms of fraud and financing because of associated risks in asset theft and credit management. Having said that, supply chain finance fintech service providers employ blockchain in logistics which is highly secure in terms of data to provide greater visibility to monitor assets and transactions at any given time with automated fraud detection.

- Smart Contracts: The logistics industry involves enormous paperwork for contracts and payments from shipment to delivery resulting in loss of time and is often prone to error and risks. This is why fintech in logistics can be a gamechanger because it utilises blockchain in logistics with pre-determined conditions for smart contracts that enable automated processing of data and payments once the requirements are met without the need for an intermediary or loss of time.

Let’s Wrap Up!

Financial supply chain management involves frequent information and payment exchange to efficiently accomplish the assigned tasks. However, traditional or manual solutions take the backseat in a highly competitive market with an ever-increasing demand. Therefore, the integration of fintech services in logistics and supply chain management will help to streamline operations with management optimisation, financial assistance and process automation.

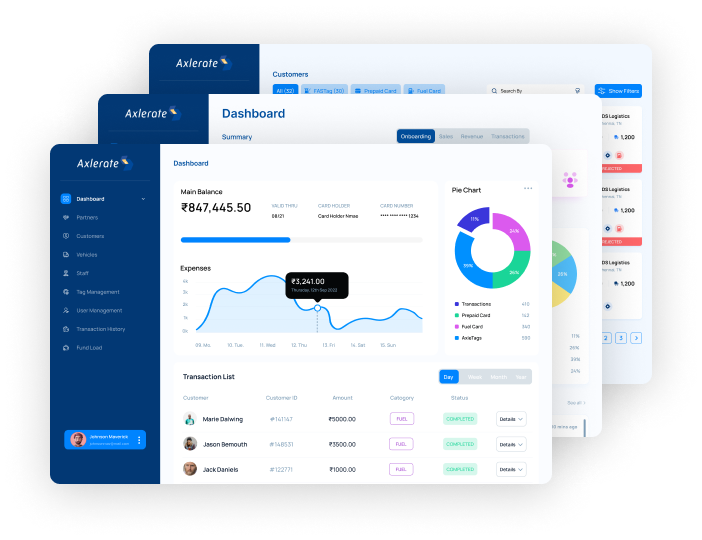

Axlerate is a unified platform for Logistics management, payments and services. Our solutions help to simplify tolls, fuel purchases, fleet expenses, loans, insurance, escrow, payments, truck booking, fleet management and the buying and selling of logistics products and services.